21 Popular Science Books That Will Change Your Life and Expand Your Mind

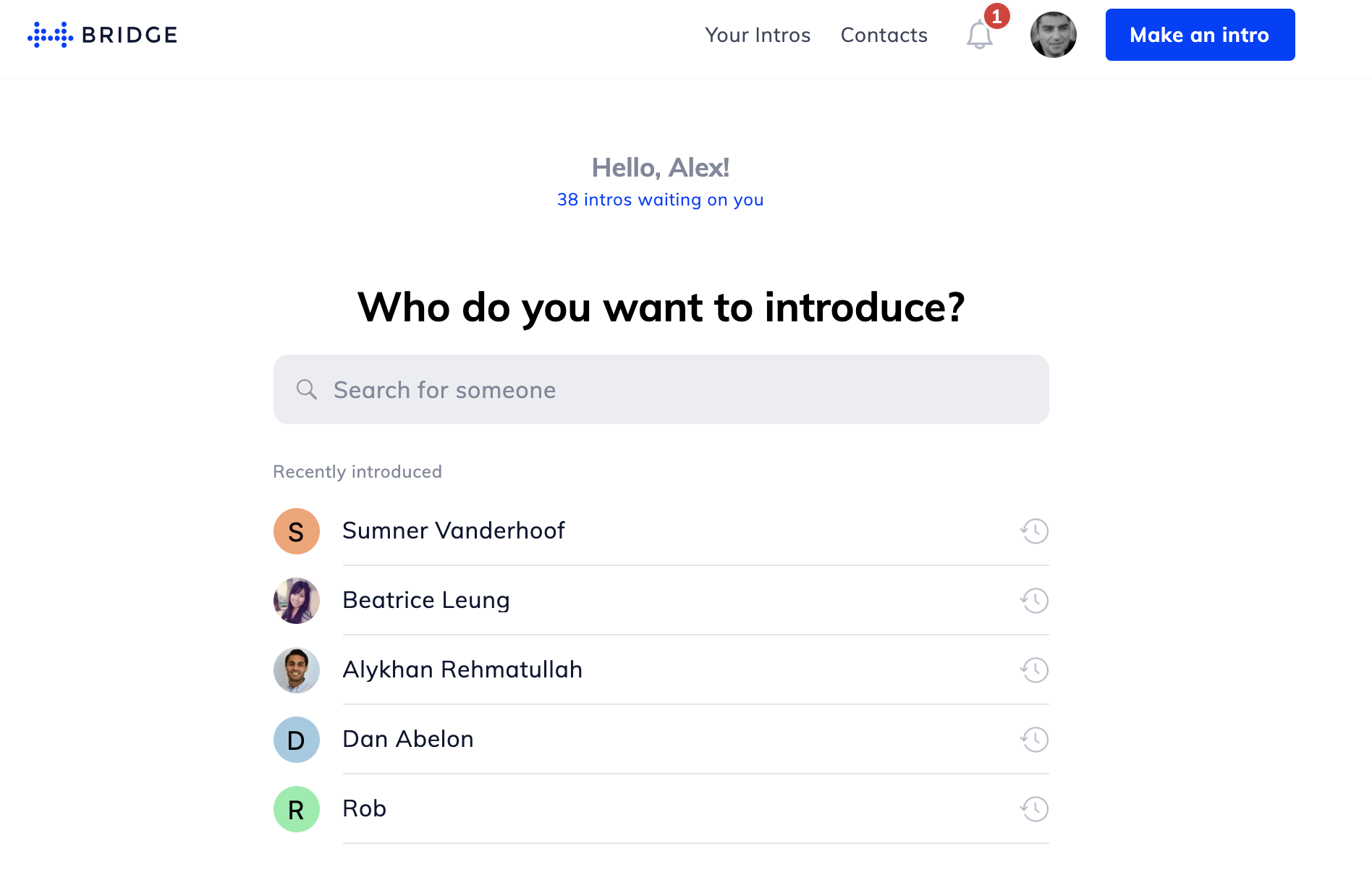

My friend, Connor Murphy, a founder and CEO of Bridge, asked me recently about my super powers.

One of them is that I spent 15 years obsessively reading popular science books and specifically, I read a lot about Complex Systems.

Knowledge of any kind is a super power.

7 Truths Across Venture Investing Stages

I recently wrote a blog post called 8 Myths of the Pre-seed Venture Investing.

In that post I talked about how different the pre-seed stage is from Series A and later stage investing. The focus of this post is the opposite: I want to highlight things that are true across stages of investing.

Truth 1. Venture outcomes are driven by a power law

Power law is an immutable law of the universe. Examples include the distribution of population in cities, price of artwork, and of course, and unfortunately, wealth distribution.

Why I love Investing in Pre-Seed Startups

I've been investing in a Pre-seed startups for the past 7 years and I absolutely love it.

It is a rare privilege for a human being to be able to afford to do what they love, and to find their true calling. I believe I found it in my current job, and for as long as I live I don't intend to do anything else.

As I've written here before, pre-seed investing is fundamentally different from other venture capital stages. So why do I love investing in pre-seed so much?

12 Questions Before You Launch a Startup

Starting a company is one of the most rewarding, amazing and hardest things you can do as a human being on this planet.

You have a shot at changing the world, creating wealth, fulfilling your dreams, learning and growing. You also need to be ready for incredible obstacles, mental and physical exhaustion, and a potential for a painful failure.

At times, founders start companies out of pure passion, a blind belief they just have to do it. It is a combination of passion, creativity and internal drive. It is like poetry, painting, or another form of art - it just has to come out.

Founders Guide to the Secondary Stock Sale

When investors invest in a startup, they typically purchase a preferred stock directly from the company. Such transaction is known as a Primary stock sale.

But what if the founders wants to sell some of their common shares? Such transaction is called a Secondary stock sale, and has become increasingly popular mechanism for rewarding the founders who achieved significant growth in their business.

3 Daily Walks for self-care and productivity

Going for a daily walk in the morning is a game changing life hack.

My life is a web of many routines. I take self-care, calendaring, and productivity very seriously.

Since the start of the pandemic, I’ve added a new routine - almost daily, weather permitting, I go on a 25 mins walk.

Getting in the exercise is great, but that’s not the only reason I do the walks.

The Perfect Investor Deck for raising Series A

We wrote here about building a deck to raise a seed round.

Raising a Seed round is very different from raising a Series A.

Because of the stage of the company the process is going to be different - you will need to find a lead, and plan your entire financing. The dynamics of the round are going to be different, the due diligence process will be more rigorous, and the expectations of the investors will be different as well.

8 Myths of the Pre-seed Venture Investing

I’ve been investing at the pre-seed for the last 7 years. First through the Techstars NYC and now as a Managing Partner at 2048 Ventures.

Pre-seed investing presents a unique set of challenges as compared to later stage (series A+) venture investing: the signals, the data, and the strategy could not be more different.

Like every industry, venture capital has tried and true advice that is often passed around between fund managers. But, like in every other industry, the advice needs to be contextualized.

A Fair Pricing Model for Pre-Seed Rounds

Historically, pre-seed rounds have been done using convertible notes, pre-money SAFEs, post-money SAFEs and equity.

With an equity financings, the founders needed to find so called Lead Investor. Typically a lead is a VC or Micro VC who conducts the diligence and then issues a term sheet. One of the items in the term-sheet is a pre or post money valuation, which determines price per share.

The key thing is that everyone in the equity round gets the same price - that is, the price that the Lead Investor offered in the term sheet.

Bridge: 10x your introductions, and build a better professional network

An introduction is a first step in making a connection, and connections in business and venture are magical.

Over time individual connections accumulate and form your professional network, and that network, when constructed with attention and care, can be incredibly powerful.

The $1k Project

If you told me 10 days ago that I would be a 4x founder, I would certainly be very surprised.

But exactly 10 days ago, I posted this Twitter poll, asking how many people would be interested in directly helping another family in need, that has been impacted by the pandemic.

I was overwhelmed to see that so many people would be willing to step up and help.

6 scenarios for raising capital amidst the growing uncertainty

History tends to repeat itself.

We have good times and not so good times. The market is cyclical.

With the election turmoil ahead we were already poised for uncertainty. Corona virus pored a lot of gasoline on this fire.

Yesterday Sequoia Capital called Corona virus the Black Swan of 2020.

This is a dramatic description, but an accurate one. Their post is full of smart advice, please go read it.